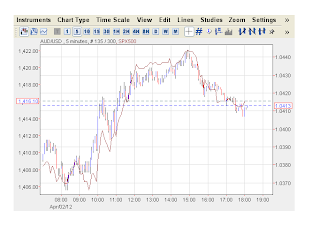

After many days we got a 1% sell off. It reminded people that stock can go down as well. However and a big however, I did not get the sell signal yet. It is getting pretty pretty close and all the signs of a topping process are there. But we have calling that top many times before and this time I want to be 100% sure. More the reason that we will get the parabolic finish to mark the end.

Pandits are saying that the stock market sold off because it is disappointed with no QE3. People in the know do not for a moment think that a QE3 is coming now. Already operation twist is going on. The Fed is already pumping in money in the system. Why do you think we went up from 1080 to 1400 in the 1st place?

Let me quote from Lee Adler of Wall Street Examiner:

In today's conomic news, the mainstream media focused on the disappointment surrounding the FOMC Minutes, the massaged and sanitized fairy tale about what the participants said at last month's FOMC confab. The market was shocked! SHOCKED! that most of the members saw no need for additional QE, unless things got worse. I had concluded that a couple of months ago based on the fact that every time QE speculation arose, not only did stocks rally, but so did energy and other commodity prices. The commodity vigilantes, I thought, would tie the Fed's hands. That and the fact that the conomic data was coming in relatively perky, at least in terms of the headline data, made it highly unlikely that the Fed would do any more money printing.

But here's the thing. The minutes are fake. They are fabricated, false, phony, ginned up and sterilized garbage, designed for public consumption. To put it bluntly, they're propaganda. They are what the Fed and the Wall Street casino owners want you to think. They are a blatant attempt to manipulate the behavior of market participants through the use of clever turns of phrase. The Fed wants the market to go higher, but it doesn't want commodities to go with it, so its story line is that the conomy is healthy enough to continue growing without more QE. That gives traders reason to continue buying stocks, and no reason to buy commodities, which everyone "knows" go up when the Fed prints, in spite of Bernanke's denials that he's doing that. And besides, even if he was, commodities are up for other reasons, not anything Ben did, according to Ben.

That's what these "minutes" are about, self justification and market manipulation. We won't know the real story until February 2018 when the Fed will release the transcripts of this year's FOMC meetings. Why do they hold them back for at least 5 years? Because the Fed thinks that you can't handle the truth. The problem is that you can and they just don't want you to know what it is, because if you did, you'd be able to make informed investment decisions. The decisions the Fed wants you to make are to buy stocks, buy and hold Treasuries, and sell commodities. They tailored the minutes accordingly, so that the headlines would elicit the desired response. They think that they're Pavlov, and we're the dogs.

And I fully agree with Lee. The immediate result has been drop in commodity prices. Oil is down to $ 100, gold and silver is down. And stocks will continue to climb soon. May be as soon as from tomorrow and we will definitely see a new high before we roll over. I am sure we will see 1440 soon before bear attacks. Today we had a confirmed double bottom and a confirmed breakout.

We will see what tomorrow brings. The trend is still up until broken. Thank you for reading my blog. Please visit

http://bbfinance.blogspot.ca/ and follow me on Twitter (@BBFinanceblog). You can post your comments in the blog or email me directly at

bbfinanceblog@gmail.com. I look forward to hearing your thoughts.