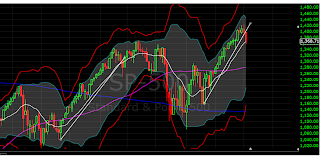

I would like to share one chart from Stock Trader’s Almanac which they have put out in their free report.

This chart makes the distinction of a Presidential Year cycle. Because all incumbent Presidents try to pump the market and the current one is no exception. They all need money from Wall St and TBTF Banks for their campaign.

This chart became available only yesterday. But I have been writing the same thing for past so many days and months.

The only thing that is important to the market; How much money is out there and where that money wants to go. To all the Uber economorons out there who are predicting imminent doom of fiat money, sorry guys, I have some bad news for you. You will have to wait.

Did you read the latest efforts of global re-flation? IMF has just increased its war chest by $ 440 billions and most of the money is coming from the developing countries. http://www.reuters.com/article/2012/04/21/us-imf-idUSBRE83I19X20120421

This is specially aimed for Spain and Italy. Why do you think the central banks will stop here? What prevents them to write another cheque to themselves again. Isn’t that they are doing for so many months?

There is a time for everything, even for serious corrections. If you look at the monthly chart of SPX

We are in a range for over 15 years now and are about to complete the upper side of the range before any serious correction can happen. Let ZH scream and shout about Spain and break up of Euro, nothing much is going to happen till the end of 2012. For now it’s all noise and fear mongering is a very good business model.

However, that does not mean I am suggesting that we should go long now. On the contrary, I think we have a short term opportunity for a fishing expedition when a short and violent correction takes place. I expect that correction, between 5-10% should start by next week, after Apple results. I plan to write a short note on Apple tomorrow. I think end of such correction will be a buying opportunity, not now. For now, we can either sit on cash or try the short side, but do not expect any major correction.

I wish you a very enjoyable weekend. Thank you for reading http://bbfinance.blogspot.ca/ . Please forward it to your friends and invite them to join me in twitter. ( @BBFinanceblog).